26+ payroll calculator kansas

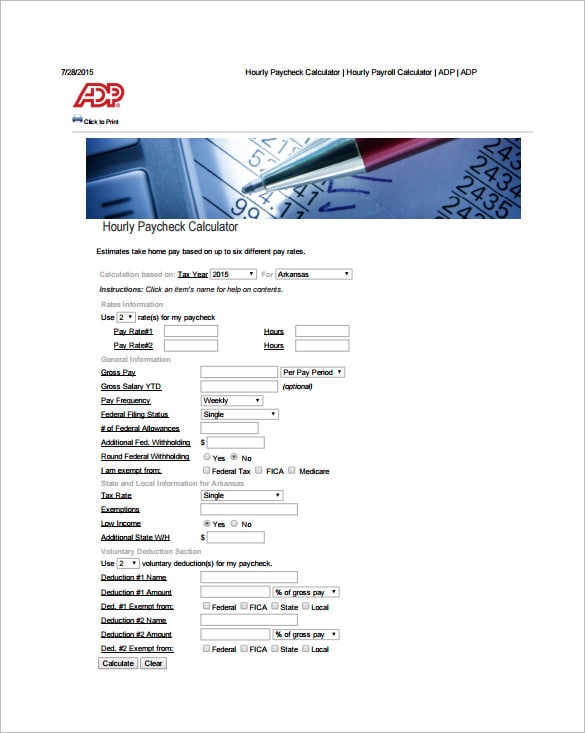

Ad Process Payroll Faster Easier With ADP Payroll. Some years will have 27 pay periods.

Kansas Paycheck Calculator Smartasset

State of Kansas Withholding Tax Rates Single or Married State of Kansas Withholding Tax Tables Single or Married State of Kansas Tax Calculator.

. Ad Compare This Years Top 5 Free Payroll Software. Enter your info to see your take home pay. 0 some cities and counties levy local taxes on interest and dividends.

Web Multiply the number of qualifying children under the age of 17 by 2000 plus the number of other dependents times 500. All you need to get started is to enter each employees wage and W-4 information. Calculating your Kansas state income tax is similar to the steps we listed on our Federal paycheck calculator.

Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kansas.

Ad Compare This Years Top 5 Free Payroll Software. Overtime Kansas employers who are covered under the Fair Labor Standards Act FLSA must follow the federal overtime rules which require employers to pay non-exempt employees one and one-half the regular rate of pay for hours worked over 40 in a workweek. Web Kansas Hourly Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

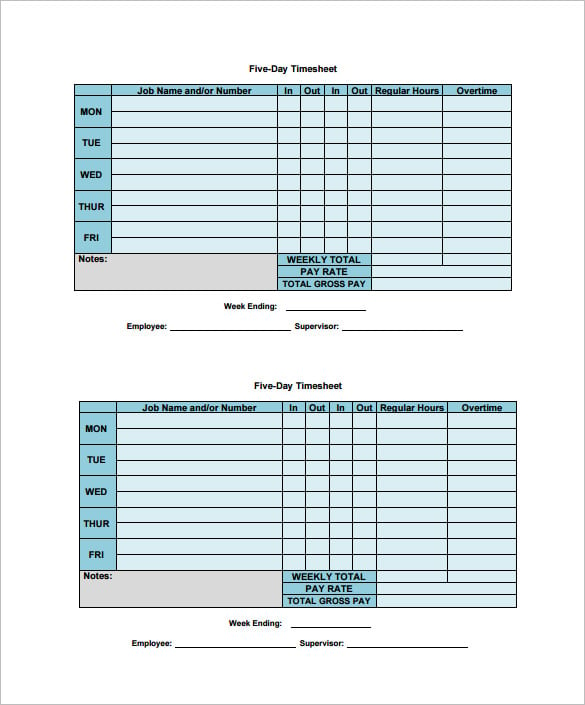

These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. Hourly rate Annualized Pay divided by 2080 Biweekly rate Annualized Pay divided by 26. Paid by the hour.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Your average tax rate is 1167 and your. Formulas are based on years with 26 pay periods.

Figure out your filing status. Ad Payroll So Easy You Can Set It Up Run It Yourself. Lets Talk ADP Payroll Benefits Insurance Time Talent HR More.

All Services Backed by Tax Guarantee. Launch Free Calculator OR See. Web Kansas Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

Our payroll calculator will figure out both federal and Kansas state payroll taxes for you. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Web We designed a handy payroll tax calculator with you in mind so that you can focus more on your business and less on taxes.

In total there are 26 pay periods each year for 12-month employees and 20 pay periods for 9-month employees. Web Kansas Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Kansas you will be taxed 11373. Enter the amount of other income you expect this year for which income tax will not be withheld.

Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Get Started With ADP Payroll.

Web The Kansas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Kansas State Income Tax Rates and Thresholds in 2023. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying. Simply enter their federal and state W-4 information as well as their pay rate deductions and.

Web Kansas tax year starts from July 01 the year before to June 30 the current year. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll.

These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. Human Capital Services provides several resources to assist employees in monitoring and managing their pay. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Payroll Kansas State University employees are paid on a bi-weekly payroll basis. Last Updated on March 20 2023 By entering your period or yearly income together with the relevant federal state and local W4 information you can use our free Kansas paycheck calculator to calculate your net pay or take-home pay.

This may include interest dividends and retirement income. Census Bureau Number of cities with local income taxes. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kansas.

Web The Kansas withholding allowance amount is 225000. Web Kansass minimum wage rate is currently 725 per hour. All Services Backed by Tax Guarantee.

Refer to the Calendar for number of pay periods in a. Free Unbiased Reviews Top Picks. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Web Use the formulas below to calculate your standard hourly and biweekly pay based on your annual salary. Web Paycheck Calculator Kansas - KS Tax Year 2023. Switch to hourly Salaried Employee.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Free Paycheck Calculator.

Web Kansas Paycheck Quick Facts. Lets Talk ADP Payroll Benefits Insurance Time Talent HR More.

8 Salary Paycheck Calculator Doc Excel Pdf

Ex 99 1

Page 3 26 Flats Without Brokerage For Sale Near Akta Provisional Store Phase 4 Gidc Vatwa Ahmedabad

724 E 715th Rd Lawrence Ks 66047 Mls 157721 Zillow

Kansas Paycheck Calculator Smartasset

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Cedar Springs Rentals Bonner Springs Ks Rentcafe

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Horizons East Apartments 505 N Rock Road Wichita Ks Rentcafe

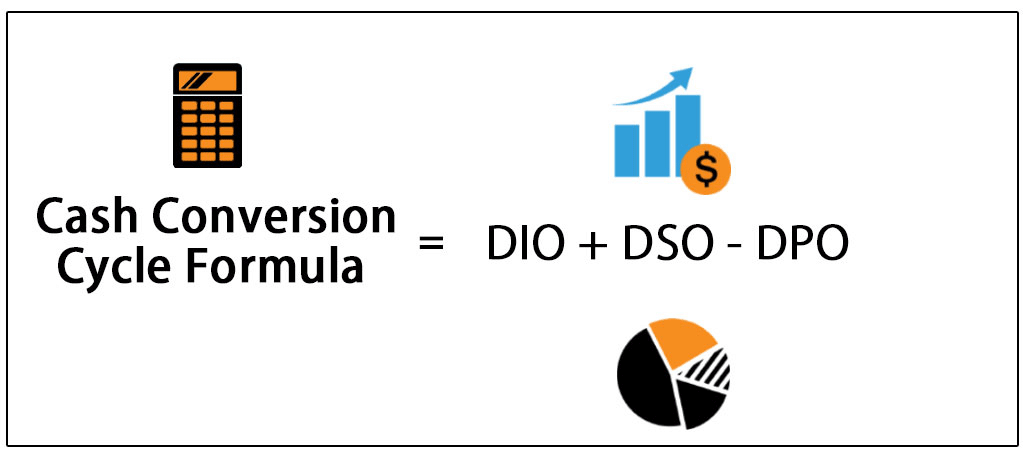

Cash Conversion Cycle Ccc Formula

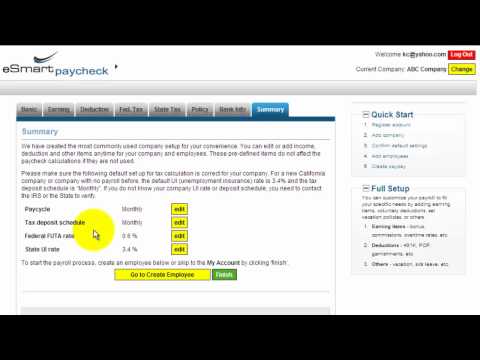

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

7 Weekly Paycheck Calculator Doc Excel Pdf

Iqpuvuu Pusb6m

Hourly Paycheck Calculator Nevada State Bank

Apply For Scholarships Northeastern Oklahoma A M College

Roster Rules And Regulations Mlssoccer Com

Kansas Salary Paycheck Calculator Paycheckcity

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee